Module 1: Introduction to Gold Trading – The Ultimate Beginner’s Guide

Gold has long been a trusted store of value, used by civilizations for thousands of years. In modern times, it remains a key financial asset, offering traders a way to hedge against inflation, market uncertainty, and currency fluctuations. Gold is one of the most popular investment choices among traders looking for stability, inflation protection, and profitable opportunities. Whether you're new to trading or looking to refine your strategy, understanding how the gold market works is essential.

In this module, we’ll break down the fundamentals of gold trading—when to trade, what moves gold prices, and how you can make informed decisions. Unlike stocks or cryptocurrencies, gold follows a unique market rhythm, influenced by economic trends, interest rates, and global events. By the end of this section, you’ll have a clear grasp of how to approach gold trading with confidence, setting the stage for profitable opportunities in the market.

👉 Why Trade Gold?

- It’s one of the most stable and liquid assets in the world.

- Gold is a safe haven during economic downturns.

- It offers diverse trading options—CFDs, futures, ETFs, and spot trading.

- Opportunities for short-term and long-term profits.

First, Gold in Trading Platforms is Also Called = XAUUSD

Here are some important terms you need to know:

- TP = Take Profit

- SL = Stop Loss

- BE = Break Even

- CL = Cut Loss

- Layer = Re-entry

- MC = Margin Call

- TL = Trendline

- MM = Money Management

- SNR = Support & Resistance

- SND = Supply & Demand

The Time to Trade ⌛️

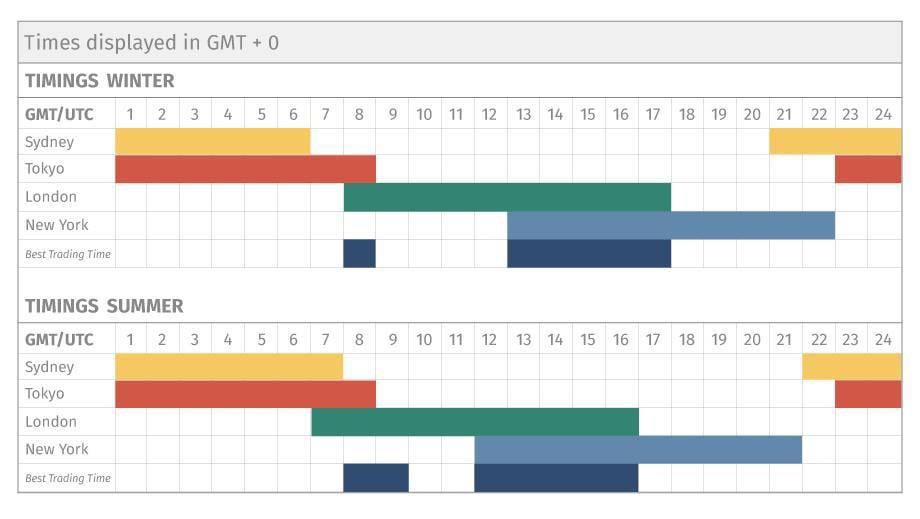

There are 3 MAIN trading sessions:

- Tokyo

- London

- New York

Market Movement

There are 2 types of movements:

- Bullish: Market is increasing or going through an UPTREND. In a bullish market, traders will BUY at a lower price and sell once the price has increased to make a profit.

- Bearish: Market is going down, usually called a DOWNTREND. In a bearish market, traders will sell at a high price and close their positions at a lower price to make a profit.

Two Types of Trends in the Market ✌🏻

- Bullish / Uptrend: Market goes upwards, and the price peaks higher than before. HH means Higher High, HL means Higher Low. The space between HH and HL is called Retrace, and the trend is known as a Bullish Trend.

- Bearish / Downtrend: Market goes to the lowest price, lower than before. LH means Lower High, while LL means Lower Low.

Timeframes (TF)

There are 9 timeframes provided on every trading platform:

- M1 - 1 minute

- M5 - 5 minutes

- M15 - 15 minutes

- M30 - 30 minutes

- H1 - 1 hour

- H4 - 4 hours

- D1 - daily

- W1 - weekly

- MN - monthly

Note: The higher the Timeframe, the stronger the trend or pattern.

How To Make Profit? 🤔

We can make a profit by buying or selling gold (XAUUSD).

- BUY when the price is LOW.

- SELL when the price is HIGH.

Understanding Margin Call

What is a Margin Call in Gold Trading?

A margin call happens when your trading account doesn’t have enough money to cover potential losses, and your broker asks you to add more funds. This usually occurs in leveraged trading, where you borrow money to trade larger amounts of gold. If the gold price moves against your trade, your account balance drops, triggering a margin call. To avoid this, always monitor your trades, use stop-loss orders, and manage risks carefully. Understanding margin calls helps you trade gold smarter and avoid unexpected losses.